The time and cost of transitioning the mining industry towards a greener future

An upsurge of public support for climate action, both at home and abroad, has put several industries on notice that more needs to be accomplished to reduce CO2 emissions due to the impact it is having on the climate.

Politicians have taken heed of the movement and are rallying around this notion. This has been witnessed at several high-profile climate related events. One of these is the Paris Agreement, which has the goal of reaching net-zero CO2 emissions by 2050, whilst maintaining mean global temperatures rise to below 2oC pre-industrial levels. This agreement has been signed by 193 countries that are committed to global climate change.

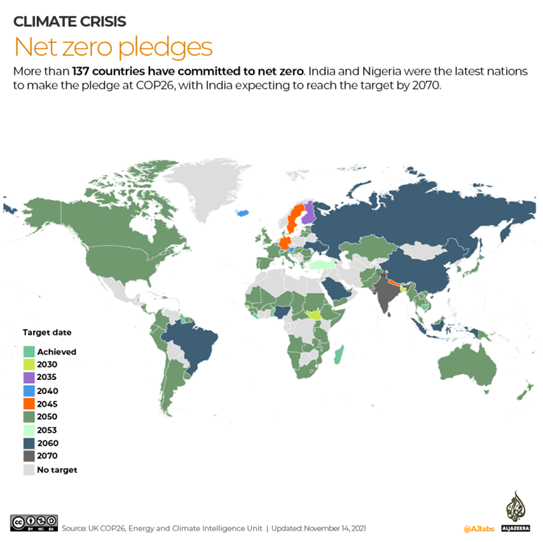

More recently, the Glasgow Climate Change Conference (COP 26) was able to establish a commitment towards net-zero emissions by a staggering 137 countries, albeit each having varying target dates.

Source: Al Jazeera

Countries are already starting to act. In the US, the Green New Deal is a government led, society-wide effort to significantly reduce emissions to net-zero over the next ten years and shift the US economy to be less carbon intensive. Across the Atlantic, the European Green Deal is making huge strides towards the goal of a climate neutral European Union by 2050.

The economics of decarbonising

Going green and decarbonising is not a cheap exercise.

The Green New Deal (GND) for instance is a climate change proposal estimated to cost around $8 trillion over a 10-year span. This policy is a true investment where returns are expected, not a government grant or handout. But like any investment, returns are never guaranteed and it’s usually the taxpayer that suffers, should a renewable project not pack the punch it was intended to deliver.

The European Green Deal is also looking like a costly initiative with the European Commission foreseeing a €1 trillion investment to fund carbon capture and renewable energy projects. There is a good chance this number may in fact rise even further due to the sanctioning of Europe’s prolific energy provider, Russia, and the Union’s desire to become less reliant on its cheap gas and oil.

These eye-watering amounts haven’t gone unnoticed here in Australia where decarbonisation too has been supported by the public, making governments and corporations reassess their long-term energy goals. For Australia, its estimated over $165 billion will need to be spent on new clean energy projects over the next 8 years if we are to realistically reach net-zero emissions by 2050. To reach this figure, Australia would need to triple its current annual spend of $7.7 billion for renewable energy projects.

Decarbonising the mining industry

The global metals and mining industry is accountable for around 8% of carbon emissions. Many environmentalists point fingers at the industry for its dirty practices and contribution to global warming. Even if it is done via a tweet from a mobile phone, that can be made up of over 30 different rare metals, whilst sitting in their lithium-ion-phosphate battery powered electric vehicle.

The key with mining is its economic contribution, which when compared to that of other industries, has a very small footprint. Most mining products have a uniquely high value per tonne of CO2 compared to that of energy, agriculture and construction, which contribute 25%, 13% and 38% respectively to total global carbon emissions.

To reduce this 8% figure, decarbonisation methods would need to be implemented. There are several ways to do this.

- Transition mining fleets away from diesel power to hydrogen or electrical

- Utilisation of carbon-zero energy sources

- Electrify as much of the distribution and logistical infrastructure

Challenges

Transitioning fleets away from diesel power and creating a carbon-zero energy site brings several challenges:

- The mine sites power load will be impacted and require balancing

- Reliable and affordable sources of electricity that the mine can depend on.

- An energy grid that is indeed ‘green’ which, depending on size of mine operation, will likely be operated by government/supplier who will need to ensure renewable sourcing

- Increase in electricity consumption will be hard to define

- Battery storage technology still limited for mining trucks that require constant operation

- Finding Original Equipment Manufacturers (OEMs) and battery providers willing to partner with miners and make this type of innovation scalable and affordable.

Return on Investment (ROI)

Taking the above challenges into consideration, the question remains, can the costs of decarbonisation warrant the change?

For the Australian mining industry, host to some of the world’s biggest and cash-rich companies, the answer is yes. But slowly. It is not clear the exact value of the ROI of decarbonisation, as there are many factors to consider in these investments as well as the returns. The reason for the slow approach is two faceted.

Firstly, mining operations are usually scattered in remote locations meaning broad investment towards these greener solutions can be hard to scale and costlier to implement.

Secondly, current decarbonisation options are hugely expensive, pricing smaller miners out. This expense also needs to be considered for mine sites with a shorter lifespan as those with anything less than 5-10 year couldn’t justify the major investment.

Decarbonisation is a huge challenge for the mining industry but also an opportunity. Several obstacles will need to be overcome, with technology, capital investment and government/stakeholder assistance to name a few.

The mining industry is in some regard stigmatised for being highly pollutive. When compared to other industries that don’t deliver nearly as much economic value yet are far more potent in their emissions, it's hard to validate the negative focus that it receives. Being an innovative industry that regards competitive advantage highly, it’s fair to say that the sustainable and ESG movement will begin to reshape the mining industry in the not too distant future.

09 May